Are you saving enough for retirement? Does it feel like the amount needed to stow away for retirement is too much? It can sound like something hard to do when you hear a person should be contributing 12%- 15% of their salary toward their retirement account. This is especially true if you are accustomed to contributing 4% or 5% of your pay to your retirement account. Participants should think about retirement savings like they do when they think of starting a workout regimen. You would initially start out with a shorter distance if you are running and then increase your distance gradually. The same concept should be used when saving towards your retirements dreams. Start out with a contribution amount that is manageable but meaningful then challenge yourself to increase your contribution amount by 1% every year.

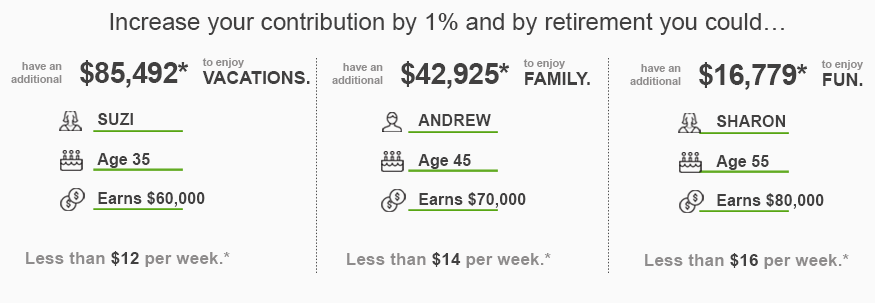

Let’s look at some examples provided by Fidelity.

*Approximation based on a 1%, 3%, or 5% increase in contribution. Continued employment from current age to retirement age, 67. We assume you are exactly your current age (in whole number of years) and will retire on your birthday at your retirement age. Number of years of savings equals retirement age minus current age. Nominal investment growth rate is assumed to be 5.5%. Hypothetical nominal salary growth rate is assumed to be 4% (2.5% inflation + 1.5% real salary growth rate). All accumulated retirement savings amounts are shown in future (nominal) dollars.

Like you would challenge yourself in the gym to lift more or run a longer distance. You need to challenge yourself to save a little more. If it’s a 1% or more increase, the extra money saved today could make a big difference in helping achieve the retirement lifestyle you see yourself living.

Ruben Hernandez CPFA

Retirement Plan Consultant

![]()

Source: https://www.fidelity.com/viewpoints/retirement/save-more